Award-winning PDF software

Irs secure access registration Form: What You Should Know

You must complete a Massachusetts rental application form .pdf Massachusetts Rental Application Form (Free Template) Jan 23, 2025 — New, full-time rental applicants (18 or older) must provide a copy (with a signature) of their most recent payment if they can't meet this demand with a check or a money order. If payment has been sent (to pay for the property, to pay taxes or other costs of renting) to an individual who doesn't have a home address, then you must provide a letter from that individual that states the amount paid, the date it was sent, the name and mailing address of the payer and a copy of a picture ID of that individual (such as driver's license/passport/driver's license number, Social Security card, etc.) To be approved, the applicant must complete the application in the space provided on the form. The applicant must enter all information requested on the application except for personal information and date of birth and state name. The applicant and his/her new roommate are required to agree that there's no problem with the application process and agree that the applicant will have a roommate and that no disputes will be brought with the landlord. No exceptions. Massachusetts Residential Rental Application (Free Template) Feb 10, 2025 — The MA Residential Rental Application is a required form for the full-time residents (18 and older) who wish to rent out their own dwelling or space of the same property. A Residential Rental Application can be completed online at Massachusetts Residential Rental Application (Free Template) June 14, 2025 — The Massachusetts Residential Rental Application is a required form for the substituted tenants (14 to 17 and under) who wish to rent out their own dwelling or space of the same property. A Residential Rental Application can be completed online at Massachusetts Residential Rental Application (Free Template) You must fill out an application for housing with your roommates. This page is for filling out the form only and don't submit any of your financial information or proof of payment.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8546, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8546 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8546 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8546 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

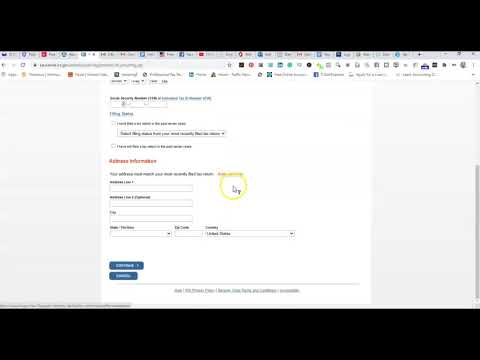

Video instructions and help with filling out and completing Irs secure access registration