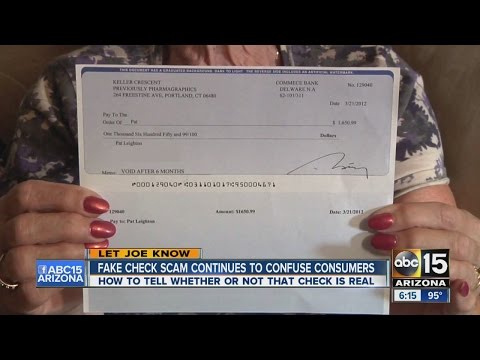

They can check in the mail for something you didn't do sounds great but it's not a good thing as scam Week continues tonight investigator Joe Ducey lets you know why so many people fall for this one and how to know if that check is really good she would work from home I was supposed to be making twenty one hundred dollars a month he would test customer service how I was treated by the cashier or anyone else that represented Walmart both put resumes on job sites got hits and payment right away it was like 17,000 I think seven hundred and sixty dollars four hundred dollars that came with the original mail that's Rick Todd you yes she sold cosmetics online and found a buyer sending more than asking price one thousand six hundred and fifty and she only owed me four hundred and fourteen they each got checks from legitimate banks for large amounts like these the ones that people send me every day asking can I deposit them are they real yes and no banks allow the deposit but the checks are fake and you don't find that out until after the scammer has instructed you to take out some of the money and send it back to them your money's gone so how do you check a check we found this Federal Reserve website and looked up this check Dottie sent me I found the business is real but when I put in the check routing number and the bank listed they didn't match or you could just live by this rule you don't get money for nothing deposit one of these upfront checks and you lose every time go to ABC 15.com click on sections and let Joe Nell sign up for our...

Award-winning PDF software

Why has my check to the irs not been cashed Form: What You Should Know

The IRS takes the health and safety of their taxpayers seriously, and will take appropriate steps to resolve any concern with your payment. The IRS does NOT make this available. Please refer to your payment agreement for other options. If you need further information, it can be obtained from your payment agreement. No, the IRS does not pay via credit card. No, you can submit a complaint through the Freedom of Information Act. You can check your payment status here. The following forms are accepted: IRS Tax Return Payment Form Pay Online Payment Status Form I.R.S. Payment Status and Form Information The IRS generally receives 1,000 to 2,500 returns each day and will process them as soon as possible. But, if the agency processes more than 3,000, it will send out notice of your status. If the IRS is unable to process your payment, it will return you to the payment approval line for processing. Please remember to review your payment agreement carefully before placing your payment, as the payment can be rejected if the agreement is incomplete or is incorrect. Please ensure that you complete and sign in your account. If you are unable to obtain and complete the electronic form because of a technical problem, or you feel that an application has been unnecessarily denied, please contact our Taxpayer Advocate at , extension 716, TIP 716, or and speak to a staff member for assistance. The following forms are accepted: IRS Tax Return Payment Form Pay Online Payment Status Form I.R.S. Payment Status and Form Information The IRS generally receives 1,000 to 2,500 returns each day and will process them as soon as possible. But, if the agency processes more than 3,000, it will send out notice of your status. If the IRS is unable to process your payment, it will return you to the payment approval line for processing. Please remember to review your payment agreement carefully before placing your payment, as the payment can be rejected if the agreement is incomplete or is incorrect. Please ensure that you complete and sign in your account. If you are unable to obtain and complete the electronic form because of a technical problem, or you feel that an application has been unnecessarily denied, please contact our Taxpayer Advocate at, extension 716, or, extension and speak to a staff member for assistance.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8546, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8546 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8546 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8546 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Why has my check to the irs not been cashed