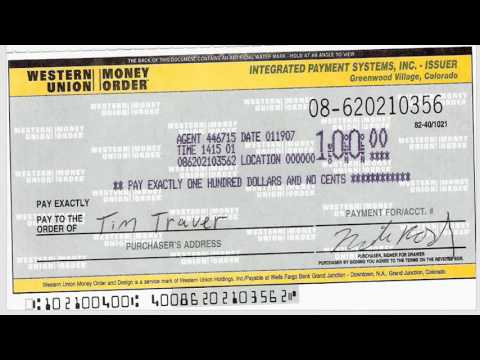

Hey guys, welcome back. I'm going to show you how to fill out a money order from Western Union. I've had some trouble with money orders in the past, so I want to help you guys avoid any issues. Let's get started! A Western Union money order has three or four parts. The first part is where you write the name of the person or organization you are sending the money order to. For example, if you are paying for your school fees, write down your school's name in this section. Don't write your own name here. Next, you need to write down what the payment is for. If you are paying for textbooks, for example, simply write "books fee" in this section. Then, you need to fill out the purchaser's address. This is where you write down your own address. Make sure to include all the necessary details, such as the street number, street name, apartment number (if applicable), city, state, and ZIP code. Finally, you need to sign the money order. Don't just write your name, but actually sign it with your signature. Your signature should match how you usually sign your name. That's all there is to it for filling out a Western Union money order. I hope you found this helpful. Please subscribe to my page and like this video if you enjoyed it. You can also find more videos like this on my page. Thank you.

Award-winning PDF software

How long does it take the irs to cash my check Form: What You Should Know

How long does it take for the IRS to process my refund? — Quora In many cases, your refund may be mailed directly to your bank account as early as the end of the month you filed. But, the longer it takes you to file a tax return, the longer it takes the IRS to process the refund, as refunds are typically processed by the IRS on a first-come, first-served basis. The U.S. Treasury will send the refund by mail to the taxpayer's current address, usually within two to three weeks of the taxpayer receiving the notice stating that they have received a refund. There will be no additional waiting time once the refund is mailed. For information about the different ways to file your taxes, see our Return Filing and Paying website.

online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Form 8546, steer clear of blunders along with furnish it in a timely manner:

How to complete any Form 8546 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Form 8546 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Form 8546 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing How long does it take the irs to cash my check